Understanding Mobile Home Financing

Mobile homes, also known as manufactured homes, offer a more affordable homeownership option for many people. Unlike traditional homes, mobile homes are constructed in a factory and transported to a specific location. Since they are not permanent structures, financing a mobile home can be more challenging than financing a traditional home. In this article, we will help you understand mobile home financing, how it works, and what options are available to you.

Types of Mobile Homes: Before delving into financing, it's important to understand the different types of mobile homes available. There are two categories of mobile homes - single-wide and double-wide mobile homes. Single-wide mobile homes are typically 14 feet wide and 70 feet long, while double-wide mobile homes are twice that size. They can be installed on either a permanent foundation or placed on wheels for easy transportation.

Loan Options: Financing options for mobile homes are typically different than those for traditional homes. Those who want to finance a mobile home have two options available to them - chattel loans and traditional mortgages. A chattel loan allows borrowers to finance the mobile home itself. These loans come with higher interest rates and shorter repayment terms than traditional home loans. Chattel loans are typically quicker to obtain and require a smaller down payment. On the other hand, traditional mortgages are similar to those for site-built homes and require a more significant down payment and have a longer repayment term.

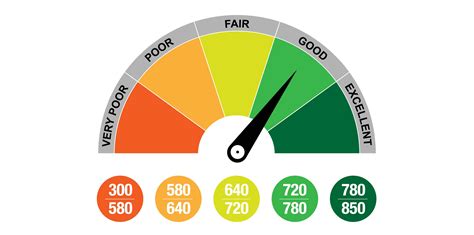

Credit Score Requirements: Financing a mobile home also requires a good credit score. It's essential to know that lenders view mobile homes as high-risk investments. Consequently, borrowers with a low credit score may not qualify for a loan, and if they do, they will likely face higher interest rates. Since mobile homes depreciate in value over time, lenders want to make sure that their investment is secured with a trustworthy borrower.

Down Payment: Down payments for mobile homes vary depending on each individual's credit score, the type of mobile home, and the loan type. Generally, down payments range from 5% to 35% of the total cost of the home. Borrowers with excellent credit scores can expect to pay lower down payments than those with lower credit scores.

Interest Rates and Loan Terms: Interest rates for mobile homes are typically higher than those for traditional homes. Since mobile homes are viewed as high-risk investments, lenders will charge higher interest to mitigate their risk. Similarly, loan terms for mobile homes are shorter than those for traditional homes, typically ranging from 15 to 25 years. The shorter repayment period ensures that lenders recoup their investment quickly and helps borrowers pay off the loan faster.

Additional Fees: When financing a mobile home, borrowers should be aware of additional charges. For instance, escrow fees are common in mobile home purchases, and borrowers should also pay for any necessary inspections and appraisals. These fees add to the total cost of financing a mobile home and should be included in the borrower's budget.

Conclusion: Financing a mobile home can be a complex process, but understanding the basics can help you make informed decisions. It's always wise to shop around and compare the different loan options to find the best terms that suit your financial goals. With accurate information, you can confidently plan for homeownership and achieve your dreams.

Benefits of Using a Mobile Home Financing Calculator

When considering purchasing a mobile home, it is essential to know what you can afford. The cost of a mobile home can range from $20,000 to $100,000, depending on the size, model, and location. Knowing how much you can afford in advance will help you determine what kind of mobile home you can buy. This is where a mobile home financing calculator comes in handy.

A mobile home financing calculator is an online tool that helps you estimate the monthly payment you can expect to pay on a mobile home loan. The calculator is free to use and can save you time and money in the long run.

Here are the benefits you get when you use a mobile home financing calculator:

1. Helps You Manage Your Budget

By using a mobile home financing calculator, you can get a clear understanding of what you can afford before making a purchase. The calculator allows you to adjust the loan amount, interest rate, and loan term to better align with your budget. This will help you make better financial decisions and avoid overspending or under-spending when buying a mobile home.

2. Provides You With a Convenient Online Tool

A mobile home financing calculator is an online tool that is readily available to you. You do not have to fill out paperwork or schedule a consultation with a financing company. Once you input the necessary information, the calculator provides you with the expected payment amount in seconds. This allows you to have more control over your finances and be proactive when it comes to budgeting.

3. Saves You Time and Money

The process of applying for a loan can be time-consuming and require multiple trips to a lending institution. A mobile home financing calculator can save you time and money by providing you with an estimate of what you can expect to pay before you apply. This can help you narrow down your options and choose a mobile home that fits within your budget.

4. Assists You in Making Informed Decisions

A mobile home financing calculator provides you with a clear understanding of the costs associated with buying and financing a mobile home. With this information, you can make informed decisions about what kind of mobile home you want to buy and what financing options make the most sense for you.

5. Gives You Room for Flexibility

A mobile home financing calculator allows you to play with different financing options and amounts. This way, you can adjust your loan amount, interest rate, and loan term according to your needs and budget. Having flexibility is essential when it comes to financing, and a mobile home financing calculator provides just that.

In conclusion, a mobile home financing calculator is a useful online tool that can help you make informed decisions when it comes to buying a mobile home. By using a mobile home financing calculator, you can manage your budget, save time and money, and make informed decisions. Furthermore, a mobile home financing calculator gives you room for flexibility and offers you a convenient online tool to make managing your finances much easier.

How to Use a Mobile Home Financing Calculator

Mobile homes provide an affordable alternative to traditional homes. However, financing a mobile home can be a challenging task. One of the fastest and easiest ways to get a clear picture of your home financing options is by using a mobile home financing calculator. These tools allow you to assess how much you can afford to borrow, the interest rates you may be eligible for, and the payment terms available.

Here is how to use a mobile home financing calculator:

1. Find a reputable mobile home financing calculator

Start by searching for a reputable mobile home financing calculator online. There are many free online calculators available that you can use to assess your home financing options. Look for calculators offered by reputable organizations, such as lenders and financial institutions, as they may provide more accurate results.

2. Enter your financial information

Once you have found a calculator that you trust, enter the relevant financial information. This can include the amount of money you want to borrow, your interest rate, your repayment term, and any other details required by the calculator.

Most calculators will allow you to adjust the loan amount, interest rate, and repayment terms to see how different scenarios can impact your monthly payments.

3. Get a detailed report of your home financing options

Once you have entered your financial information, most mobile home financing calculators will provide you with a detailed report of your home financing options. The report may include information such as the monthly loan repayment amount, total interest payable, and the total cost of the loan.

Using a mobile home financing calculator will give you a clear understanding of your financing options and allow you to make an informed decision about the type of loan you can afford. The calculator will also allow you to experiment with different loan scenarios, so you can assess the impact of changing your loan terms or interest rates on your repayments.

4. Compare your options

Once you have assessed your financing options and received a report from the mobile home financing calculator, you can compare your options to find the most affordable and suitable loan for your needs.

Consider factors such as the total cost of the loan, the interest rate, repayment term, and the monthly payment amount. Also, take the time to research different lenders and their loan products to find a lender that is reputable and offers the most competitive rates and terms.

Conclusion

Using a mobile home financing calculator is an efficient and effective way to assess your home financing options. These tools will provide you with a clear understanding of your loan terms, monthly payments, and overall costs. Remember to take the time to compare your options, research different lenders, and find a loan that meets your needs and budget.

Factors that Affect Mobile Home Financing

When people are searching for affordable housing options, mobile homes are a popular choice. Not only are they cheaper than traditional homes, but they also offer modern amenities at a fraction of the cost. But what many people don't realize is that mobile home financing is not the same as traditional home financing. There are a multitude of factors that affect mobile home financing, including:

1. Credit Score

Your credit score is a critical factor in determining the interest rate you will receive when financing a mobile home. A higher credit score typically means a lower interest rate, which can save you thousands of dollars in interest over the life of the loan. It's important to keep your credit score as high as possible by paying your bills on time and reducing your debt.

2. Down Payment

The down payment is the amount of money you pay upfront when financing a mobile home. A larger down payment can help reduce your overall loan amount and result in a lower monthly payment. It can also help you get approved for financing if you have a lower credit score.

3. Age of Home

The age of the mobile home can also impact financing options. Some lenders may limit financing on older homes, while newer homes may be eligible for longer loan terms and lower interest rates.

4. Foundation Type

The foundation of a mobile home is an important factor in financing. Homes that are on a permanent foundation, such as a concrete slab, may be easier to finance than homes with a temporary foundation, such as blocks or piers. If the mobile home is on leased land, there may be additional requirements and restrictions for financing.

5. Income and Employment

Your income and employment status are crucial in determining whether you qualify for financing. Lenders typically require proof of income such as tax returns, pay stubs, or bank statements. They also prefer borrowers who have a stable job history and a steady source of income. If you are self-employed or have a sporadic income, it may be more difficult to secure financing.

Final Thoughts

Financing a mobile home can be a complex process, but understanding the factors that affect mobile home financing can help you make an informed decision. It's important to do your research, shop around for lenders, and compare financing options before making a final decision. With the right preparation, you can find financing that meets your needs and allows you to enjoy the benefits of mobile home living.

Comparing Mobile Home Financing Options with a Calculator

Once you understand the basics of mobile home financing and know how much you can afford, you can start comparing financing options and their costs. This is where a mobile home financing calculator comes in handy.

A mobile home financing calculator is an online tool that helps you calculate your monthly payments, interest rates, and total loan costs based on the loan term, down payment, and interest rate you input. This allows you to compare different financing options and find the one that works best for you and your budget.

Here are five factors to consider when using a mobile home financing calculator:

1. Interest Rates

Interest rates are one of the most important factors to consider when comparing mobile home financing options. They can vary widely depending on the lender, loan term, and your credit score. A mobile home financing calculator can help you see how interest rates impact your monthly payment and total loan costs. You can also compare interest rates offered by different lenders and choose the one that offers the best rate.

2. Loan Term

The loan term refers to the length of time you have to repay your loan. It can range from a few years to several decades, depending on the lender and the loan amount. A mobile home financing calculator can help you see how the loan term affects your monthly payment and total loan cost. A longer loan term may result in lower monthly payments but higher total loan costs, while a shorter loan term may result in higher monthly payments but lower total loan costs.

3. Down Payment

The down payment is the amount of money you pay upfront toward the purchase price of your mobile home. A larger down payment can lower your monthly payments and total loan costs. A mobile home financing calculator can help you see how different down payment amounts affect your loan costs and monthly payments.

4. Fees and Charges

When securing financing for your mobile home, you may encounter various fees and charges, such as origination fees, processing fees, and closing costs. These fees can add up and increase your total loan costs. A mobile home financing calculator can help you estimate the fees and charges associated with different financing options, so you can choose the one that offers the lowest total loan cost.

5. Credit Score

Your credit score can impact your ability to secure financing for your mobile home as well as the interest rate you are offered. A mobile home financing calculator can help you see how your credit score affects your loan costs and monthly payments. It can also help you identify ways to improve your credit score and secure more favorable financing terms in the future.

Overall, using a mobile home financing calculator can help you compare different financing options and find the one that meets your needs and budget. It can also help you identify ways to save money and reduce your total loan costs over time.