The Downside of Hard Drinking

Drinking has been a part of human culture and society since the beginning of time. It is often considered a social activity, a way to celebrate, unwind or relax; however, it can also have negative consequences. Alcohol addiction and its effects can be devastating to the abuser, not only physically but also financially, emotionally, socially, and psychologically. In this article, we will discuss some of the downsides of hard drinking, with a focus on the financial implications.

Alcohol addiction can be expensive. According to a study from the National Institute on Alcohol Abuse and Alcoholism, in 2010, the economic burden of alcohol abuse and its related problems in the US was estimated to be $249 billion. This cost includes healthcare, criminal justice, and lost productivity. A significant amount of this cost is borne by the individual who abuses alcohol, their family, and their community. Alcoholism can lead to job loss, divorce, and unstable relationships, causing damage beyond repair.

In addition to the direct costs associated with alcohol, there is also an indirect cost that may not be immediately apparent. Alcohol can reduce judgment and impulse control, leading to reckless behavior such as gambling or overspending. Those who abuse alcohol may find themselves in dire financial straits, leading to legal problems, foreclosure, and bankruptcy. In some cases, the financial damage can be so severe that it may be impossible to recover from.

It is not just the cost of alcohol that can impact one's financial situation, but also the consequences of addiction. For example, someone with alcohol addiction may be more likely to miss work, leading to lost wages, missed opportunities, and fewer promotions. They may also be less productive and more prone to accidents, causing a financial burden to the employer as well. In some cases, alcohol abuse may also lead to chronic health conditions, causing a further drain on the individual's finances and healthcare system.

Another negative financial consequence of alcohol abuse is the impact on relationships. Marriages and other partnerships may suffer, leading to legal fees and expensive battles for custody. In some cases, the financial situation may become so dire that the individual may be forced to choose between alcohol and basic necessities such as food and housing.

The bottom line is that alcohol abuse is not only an emotional or physical problem, but also a financial one. It can cause significant damage to the individual, their family, and their community. Unfortunately, this damage can be difficult to quantify and often goes unnoticed until it is far too late. The key to avoiding the financial pitfalls of alcohol abuse is to recognize the problem early and seek help before it spirals out of control.

Drinking and Financial Irresponsibility

Drinking is often associated with having a good time and letting loose. However, what many people don't realize is that excessive drinking and financial irresponsibility often go hand in hand. When people consume alcohol, they may become more impulsive and make poor decisions regarding their finances. In this article, we will explore the relationship between alcohol consumption and financial responsibility.

The Effects of Drinking on Spending Habits

When people drink, they may lose their inhibitions and become more likely to spend money impulsively. For example, they may buy rounds of drinks for their friends or splurge on expensive items without fully considering the consequences of their actions. This can lead to financial problems down the line, such as overspending, debt, and even bankruptcy. According to a survey by Credit Karma, 25% of Americans have spent over $1,000 on alcohol in one year; this shows how alcohol can have a significant impact on one's finances.

In addition to impulsive spending, alcohol can also impair judgment when it comes to long-term financial decisions. For example, someone may take out loans or open credit cards while under the influence of alcohol, without fully understanding the terms and consequences. This can lead to a cycle of debt and financial strain.

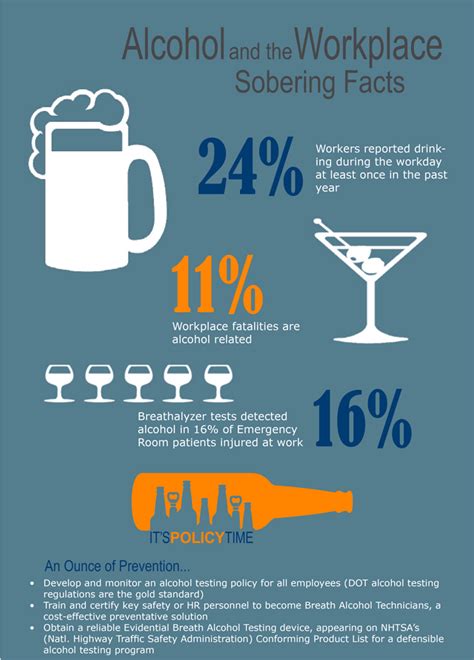

The Relationship Between Alcohol and Work Performance

Drinking can also have a negative effect on one's work performance, which can ultimately impact their finances. When someone drinks heavily, they may be more likely to miss work, show up late, or perform poorly. This can lead to lost wages, missed opportunities for promotions, and even job loss. According to a study by the National Institute on Alcohol Abuse and Alcoholism, alcohol-related productivity loss costs employers approximately $148 billion per year. This demonstrates how alcohol can have a ripple effect on one's finances and overall well-being.

Tips for Combining Drinking and Financial Responsibility

While drinking and financial responsibility may seem like polar opposites, there are ways to enjoy a night out without breaking the bank. Here are a few tips:

- Set a budget for the night and stick to it

- Only bring a certain amount of cash with you

- Avoid using credit cards while drinking

- Designate a driver to avoid costly rideshares

- Avoid making impulsive purchases while under the influence

- Take time to sober up before making any financial decisions

By following these tips, you can enjoy a night out without putting your finances at risk.

Conclusion

Drinking and financial irresponsibility often go hand in hand. When alcohol is involved, people may become more likely to make impulsive decisions and neglect their financial responsibilities. However, by being mindful of spending habits, avoiding risky financial decisions while under the influence, and taking steps to avoid overspending, people can enjoy a night out without damaging their finances. Remember, financial responsibility is always important, regardless of how much alcohol is involved.

Alcohol Addiction and Money Problems

There is a direct link between alcohol addiction and money problems. Alcohol addiction affects many aspects of life, including financial health. When someone is addicted to alcohol, they may struggle to maintain their job, which can lead to a loss of income. As their addiction progresses, they may have to spend more money on alcohol, which further impacts their financial health.

Many people who struggle with alcohol addiction prioritize drinking over other responsibilities, including paying bills or saving money. The financial consequences of alcohol addiction can range from overspending on alcohol to declaring bankruptcy. In some cases, individuals may even resort to illegal activities, such as theft or drug dealing, to fund their addiction.

One of the major financial impacts of alcohol addiction is the cost of the substance itself. Alcohol is not a cheap commodity, and as someone becomes dependent on it, the amount they consume may increase. This can quickly lead to significant financial strain. For example, if someone becomes dependent on a daily bottle of whiskey, they may spend upwards of $150 per month on just one substance. Over time, this can add up to thousands of dollars.

Another financial impact of alcohol addiction is the cost of treatment. Treatment for alcohol addiction can be expensive, and many insurance plans do not cover it. Depending on the type of treatment necessary, individuals may have to pay for therapy sessions, medications, and inpatient or outpatient programs. Some programs, such as detoxification, can cost thousands of dollars. Even after treatment, individuals may need to continue therapy or attend support groups, which can be an ongoing expense.

Alcohol addiction can also impact an individual's job security. Work performance may suffer due to addiction-related issues, such as poor attendance, decreased productivity, and conflict with colleagues. This can lead to job loss or difficulty finding new employment. Additionally, individuals may face legal consequences if their alcohol addiction results in workplace accidents or other legal issues.

Furthermore, alcohol addiction can have a domino effect on financial health. As someone's addiction impairs their judgment, they may make poor financial decisions, such as overspending or taking out loans they cannot repay. This can lead to mounting debts and financial hardships. Additionally, as someone becomes consumed by their addiction, they may neglect other responsibilities, such as paying bills or managing a budget. This can further exacerbate their financial problems.

In conclusion, alcohol addiction and money problems go hand in hand. The cost of alcohol itself, as well as the cost of treatment and lost income, can have a significant impact on an individual's financial health. Additionally, addiction-related issues can lead to job loss, legal problems, and poor financial decision-making. It is essential for individuals struggling with alcohol addiction to seek help before their financial situation becomes dire.

The hidden costs of a night out

It's no secret that a night out can be expensive. Between drinks, cab rides, and cover charges, the cost of a night on the town can quickly add up. But there are some hidden costs that many people tend to overlook. Here are just a few of the expenses that you might not have considered before heading out for the evening.

1. Tips

If you're going to be drinking at a bar, be prepared to tip the bartender. A good rule of thumb is to tip a dollar for each drink you order, or 20% of your tab if you're running a tab. And don't forget about the servers, bouncers, and cab drivers that you might encounter throughout the night. These people are all working hard to make sure that you have a good time, so show them some appreciation with a generous tip.

2. Late Night Food

After a night of drinking, you might find yourself craving some late-night food. But those street tacos or pizza slices can add up quickly! Make sure that you have some extra cash on hand to cover the cost of your late-night snack. And if you're planning on hitting up a drive-thru, don't forget to factor in the cost of a cab ride to get there and back.

3. Lost Possessions

It's easy to lose track of your belongings when you're drinking, especially if you're moving from bar to bar throughout the night. Make sure that you keep a close eye on your phone, wallet, and keys throughout the evening. If something does go missing, be prepared to pay for a replacement (or spend some time tracking it down).

4. Credit Card Fees

If you're using a credit card to pay for your drinks, you might be hit with some unexpected fees. Many bars and clubs charge extra for credit card transactions, either as a flat fee or a percentage of your total bill. Make sure that you have some cash on hand to avoid these fees, or ask the bartender if there's a way to waive the charge.

5. Health Costs

Drinking too much can have some serious health consequences, both in the short-term and the long-term. Hangovers can result in lost productivity and missed work, which can add up over time. And if you're a heavy drinker, you might be facing more serious health problems down the line. Make sure that you're aware of the risks and take steps to stay safe and healthy while you're out drinking.

While a night out on the town can certainly be fun, it's important to be aware of all of the costs involved. By planning ahead and budgeting carefully, you can avoid any unpleasant surprises and focus on having a good time.

Tips for managing finances while socializing

Going out with friends and enjoying social activities can be a lot of fun. However, this can wreak havoc on your finances, especially if you are a hard drinker. Regularly going drinking with your friends can be a significant expense, and it is essential to manage your finances effectively. Below are some recommendations for managing your finances while socializing:

1. Set a Budget

Establishing a budget can help you to control your expenses and make sure that you do not overspend your monthly allowance. Set up a budget specifically for social activities, including drinking with friends. Identify how much you are willing to spend on such activities every month and ensure that you stick to the budget.

2. Limit Your Drinks

Drinking alcohol can be expensive, especially in high-end bars. Limit your drinks to a few rounds per night, and avoid ordering premium brand drinks that are overpriced. You do not always need to drink alcohol to have a good time. Consider ordering non-alcoholic drinks that are cheaper and can be equally refreshing.

3. Choose Affordable Alternatives

If going to a bar or club for a social outing is too expensive, consider switching up your choice of location. You could suggest alternatives like hosting a house party or a potluck dinner at a nearby park. These alternatives are often cheaper, and you can still enjoy spending time with your friends, having fun and enjoying some drinks.

4. Plan Ahead

Planning ahead is another essential factor in managing your finances while socializing. When you know you're going to be going out with friends, try to plan ahead and make sure you have enough money for drinks and other activities. If money is an issue, consider skipping a month or taking a break from going out until you can afford it again.

5. Keep Track of Your Spending

Tracking your expenses, in general, is an effective way to manage your finances, and it applies to socializing as well. Create a system to track your expenses, and keep a record of how much you have spent on drinks, food, and other activities. Review your spending regularly and make adjustments where necessary. If you find that you are continually exceeding your budget, try to reduce your spending on other non-essential items to balance your finances.

In conclusion, managing your finances while socializing requires discipline and a little creativity. Implementing the tips above can help you to keep your social expenses under control, allowing you to enjoy spending time with your friends without worrying about your finances. Remember that it is always essential to prioritize your financial goals and plan accordingly to reach them.