Overview of Kubota Finance Options

Kubota is one of the most trusted brands when it comes to agricultural and construction machinery. Founded in 1890, the company has been producing high-quality tractors, excavators, and other equipment that have helped improve farming and construction industries worldwide. Kubota has a wide range of finance options to help customers purchase their machines.

It is important to note that Kubota dealerships are independent businesses that offer financing to its customers. They take pride in helping customers choose the right finance option that fits their budget. Kubota offers a range of finance options such as credit, leasing, and installment plans.

Credit financing is one of the most common financing options, and Kubota has a specialized team to provide customized credit solutions based on the customers' creditworthiness. Customers can choose to finance their purchase for as long as seven years, depending on the type of equipment. Kubota offers competitive interest rates, and customers can enjoy flexible payment options depending on their financial status and the type of equipment they choose.

Kubota Leasing is another financing option, and it is suitable for customers who want to use the equipment for a specific duration. Kubota offers flexible leasing terms tailored to meet customers' needs and budget. Customers can choose monthly, quarterly, half-yearly, or yearly payments. Kubota offers reasonable buyout options at the end of the leasing term, allowing customers to own the equipment if they decide to continue using it.

For customers looking for affordable financing options, Kubota offers installment plans. Customers can spread their payments over time, depending on the agreement with the dealership. The length of the payment option varies, and the interest rates are fixed. The installment plans offered by Kubota also include warranty and insurance coverage, ensuring that the equipment is protected during the payment period.

Kubota finance options offer customers a variety of choices that can be tailored to suit their budget and financing needs. Their financing options are suited for seasonal agricultural and construction businesses because of their flexibility. They also offer special deals during the planting and harvesting seasons.

Generally, working with Kubota dealerships is convenient, and customers can access the necessary financing to purchase their preferred equipment seamlessly. Working with a Kubota dealership is also beneficial because of their industry-leading customer service. Kubota has a strong dealership network, with over 1,100 authorized dealerships across America.

In conclusion, choosing Kubota Financing offers customers a hassle-free financing process and convenient access to high-quality machinery. The company's wide range of financing options, including credit, leasing, and installment plans, ensures that customers can easily access finance that suits their budget and needs.

Advantages of Kubota Leasing Programs

There are numerous advantages of Kubota leasing programs, making it a popular choice for customers who want to purchase a Kubota vehicle but do not want to pay the entire amount upfront. These leasing programs offer various schemes, such as Installment Sales Contracts, Lease Purchase Agreements, and Loans, making it easy to choose a scheme that best suits your needs. In this article, we shall discuss some key advantages offered by Kubota Leasing Programs.

No large upfront payment

One of the most significant advantages of Kubota leasing programs is that it does not require a large upfront payment, unlike traditional financing options. With Kubota Leasing, the customer is only required to pay monthly installments over a specific period. This means that customers can purchase a Kubota vehicle without worrying about paying a huge sum of money upfront. A fixed monthly payment makes it easier to budget and plan for operational expenses.

Tax benefits

Another advantage of Kubota leasing programs is that they offer tax benefits to customers. The IRS allows businesses to deduct the full amount of lease payments as an expense. This means that customers can claim the entire lease payment as a deduction, reducing their taxable income and saving them money. Additionally, Kubota offers tax benefits on farming equipment reducing the cost of purchasing a farming machine by a considerable amount.

Better cash flow management

Leasing a Kubota machine allows customers to manage their finances better as the monthly payments are typically lower than the cost of buying a machine outright. This enables customers to free up valuable cash for other business investments and operational expenses. When Kubota customers lease their equipment, they can return it at the end of the lease term, eliminating the risk of owning a depreciating asset.

Lower Maintenance Cost

Leasing a Kubota machine instead of buying it can save customers a considerable amount of money in maintenance costs. When customers own a machine, they are responsible for all the repairs and maintenance tasks. However, with Kubota Leasing Programs, it is the responsibility of Kubota to ensure that the equipment is correctly maintained as per the manufacturers' specifications. As a result, customers do not have to worry about repair costs and can focus on maximizing the productivity of equipment.

Access to Latest Technology

Leasing a Kubota machine provides access to the latest technology without having to buy a new machine outright, which can save customers a considerable amount of money. Kubota is well-known for its innovative approach towards machinery, and its leasing options provide customers with the flexibility to upgrade to the latest technology equipment when their lease term ends. Customers can lease a new model at the end of the term, keeping up with the latest technological advancements and improving the quality and efficiency of their work.

In conclusion, Kubota leasing programs offer several advantages, including lower upfront costs, better cash flow management, tax benefits, access to the latest technology, and lower maintenance costs. Kubota Leasing Programs have been designed to provide customers with the flexibility they need to run their businesses more effectively. It allows you to balance the benefits of owning your equipment with the financial flexibility you need to grow your business. If you are in the market for a Kubota machine, consider leasing an option as it offers numerous benefits.

Kubota Finance for Equipment Purchases

Kubota is a trusted brand in the field of machinery and agriculture, and their equipment is known for its reliability and durability. However, purchasing heavy equipment can be a major investment, and that's where Kubota Finance comes in. Kubota Finance provides financing and leasing options tailored to the needs of business owners and contractors who are looking to purchase or lease Kubota equipment.

There are several financing options available, including installment loans, leasing, and revolving credit. Installment loans are a popular option for those who wish to own their equipment outright over a period of time. This option allows the borrower to make regular payments of principal and interest and own the equipment once the loan is paid in full.

Leasing is another common option for Kubota equipment financing. With this option, the borrower does not own the equipment but leases it from Kubota over a fixed period of time. These payments are generally lower than installment loans, and the borrower has the option to purchase the equipment at the end of the lease period.

Revolving credit is yet another option for Kubota equipment financing. This option is similar to a credit card, and the borrower has a line of credit available to use as needed for their Kubota equipment purchases. With this option, there are no fixed payments, and the borrower can pay back the borrowed amount at their own pace while having the flexibility to purchase additional equipment as needed.

One of the main benefits of using Kubota Finance is the flexibility it provides. With a range of financing options available, business owners and contractors have more control over how they manage their cash flow and budgeting needs. Additionally, Kubota Finance has a team of experienced and knowledgeable professionals who can provide guidance on the best financing option based on individual circumstances.

Another benefit of using Kubota Finance is the convenience it provides. Kubota Finance offers a user-friendly online portal, where customers can make payments, review account details, and manage their financing agreements. The online portal is available 24/7, making it easy for customers to manage their accounts and stay on top of their financing obligations.

Finally, Kubota Finance offers competitive interest rates, which can help reduce the overall cost of purchasing or leasing Kubota equipment. The interest rates vary depending on the financing option chosen, but they are generally competitive with interest rates offered by other financing institutions.

In conclusion, Kubota Finance offers a variety of financing options for business owners and contractors looking to purchase or lease Kubota equipment. With flexible financing options, experienced professionals, a user-friendly online portal, and competitive interest rates, Kubota Finance is a reliable and convenient option for those looking to invest in high-quality Kubota equipment.

Understanding Kubota Credit Requirements and Terms

Kubota Credit Corporation is a subsidiary of Kubota Tractor Corporation. It specializes in providing financing services to Kubota customers. Kubota finance is available to customers looking to purchase tractors, mowers, excavators, utility vehicles, and construction equipment. Kubota Credit Corporation offers competitive credit options that help customers acquire the equipment they need to run their businesses.

To qualify for Kubota Credit, customers must meet certain credit requirements. Customers must have a valid US driver's license and obtain credit approval from Kubota Credit Corporation. In addition, customers must also provide personal, business, and financial information. This information is used to determine a customer's creditworthiness.

Credit Score

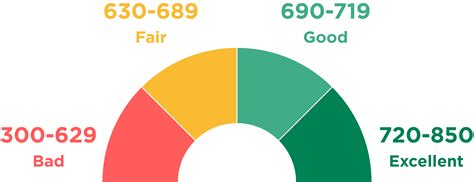

One of the most crucial requirements for obtaining Kubota Credit is a good credit score. A credit score is a rating assigned to an individual reflecting their creditworthiness. The most common credit scoring model used by lenders in the US is the FICO score. The FICO score ranges between 300 and 850.

Kubota Credit Corporation requires a minimum credit score of 650. A credit score of 650 or higher usually indicates that an individual is creditworthy and may receive favorable loan terms. Therefore, it is essential that customers work on improving their credit score before applying for Kubota Credit Corporation financing.

Down Payment

%2fdown-payment-5adde4d9c5542e0036e503a9.jpg)

Another crucial requirement for obtaining Kubota Credit is a down payment. A down payment is a deposit made by the borrower towards the purchase price of the equipment. Kubota Credit Corporation requires a down payment that ranges between 10 to 30% of the equipment's purchase price.

A down payment provides collateral for the loan and reduces the risk of default. Customers with a high credit score and a substantial down payment may receive favorable loan terms, including a lower interest rate, monthly payments, and a more extended repayment period.

Interest Rate

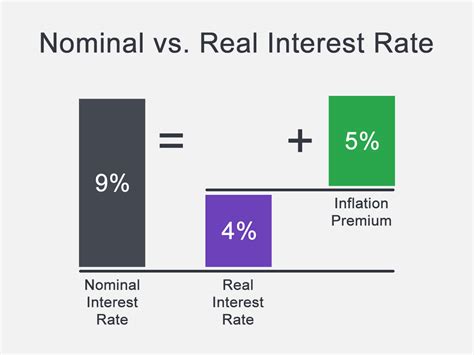

The interest rate is the cost of borrowing money from the lender. Kubota Credit Corporation offers competitive interest rates ranging between 0% to 4.99%. Interest rates vary depending on the customer's credit score, down payment, and the equipment's purchase price.

Customers with a good credit score and high down payment may be eligible for the lowest interest rate. Therefore, it is essential to improve credit scores, save for a down payment, and compare different financing options to obtain the best interest rate.

Loan Term

The loan term is the duration of the loan. Kubota Credit Corporation offers flexible loan terms ranging from 24 to 84 months. The loan term varies depending on the equipment's purchase price, down payment, and interest rate.

Customers must choose a loan term that fits their budget and meets their equipment needs. Customers with a high credit score and a higher down payment may receive favorable loan term options.

Conclusion

In conclusion, Kubota Credit Corporation offers competitive financing options to customers looking to purchase Kubota equipment. To qualify for Kubota Credit Corporation financing, customers must meet certain credit requirements, including a good credit score and a substantial down payment. Customers must also choose a loan term that fits their budget and equipment needs. By understanding Kubota credit requirements and terms, customers can make informed financing decisions and acquire the equipment they need to run their businesses.

Kubota Financing Tips for Small Business Owners

Kubota financing is an excellent way for small business owners to purchase tractor equipment with a low down payment and favorable repayment terms. However, before applying for Kubota financing, it's advisable to conduct thorough research to ensure you get the best deal. Here are five tips on how to go about Kubota financing:

1. Determine Your Budget and Needs

Before applying for Kubota financing, it's essential to determine your business's budget and needs. Make sure you have a clear picture of what type of equipment you need and how much you can afford to repay each month.

When creating a budget, take into account variables such as interest payments, fees, and insurance costs associated with financing your purchase. Assess your financial resources and determine if Kubota financing is the right fit for your business. Set a realistic budget and stick to it to avoid financial stress in the future.

2. Shop Around for the Best Deal

Before signing the dotted line, it's crucial to shop around for the best financing deal. Compare and research all the Kubota financing options available to you, including interest rates, repayment terms, and any hidden fees. Secure quotes and review them carefully to identify the most favorable financing option.

It's also essential to consult with a financing professional if necessary to help you identify the best financing deal for your business. Make an informed decision, and choose a Kubota financing option that aligns with your budget and business goals.

3. Focus on Creditworthiness

A good credit score is essential when applying for Kubota financing. The better your credit score, the higher your chances of securing better financing options and repayment terms.

Having a strong credit history demonstrates to Kubota and other lending institutions that you can be trusted to repay the loan on time and according to the terms agreed upon. It's advisable to check your credit score before applying for Kubota financing and ensure that all errors have been corrected. This can boost your creditworthiness and improve your chances of securing the best deal.

4. Understand Your Repayment Terms

It's essential to read and understand the repayment terms provided by Kubota financing, including the loan duration, repayment amount, and interest rate. Make sure you can afford to make the monthly payments on time and without fail, to avoid unnecessary interest fees and legal consequences.

It's advisable to take your time in reviewing the repayment terms and ensuring that you can meet the requirements before committing to Kubota financing. Seek the help of a financing professional if necessary to help you in this process.

5. Consider Refinancing

If you grow tired of the original financing terms you agreed to, it may be time to refinance your Kubota financing. Refinancing a loan involves replacing an existing debt obligation with a new kubota financing obligation with improved terms.

Refinancing your Kubota financing could mean lower monthly payments, reduced interest rates, or both. It's essential to explore your refinancing options since they can save you a significant amount of money in the long run. Consider consulting with a financing professional to understand the refinancing process better.

In conclusion, Kubota financing is a great way to acquire the tractor equipment your small business needs. With these five tips, you'll be better equipped to secure the best financing deal for your situation.